Global Wire and Cable Industry Review 2025 and Market Outlook 2026

The global wire and cable industry represents a fundamental pillar of modern economic systems, serving as the physical backbone for power transmission, electrification, digital communication, industrial automation, and transportation. In 2025, the industry continued to demonstrate resilient growth despite macroeconomic uncertainty, driven primarily by energy transition, grid modernization, rapid expansion of data centers, and accelerating electric vehicle (EV) adoption.

This report provides a comprehensive review of the global wire and cable market in 2025 and delivers an expanded 2026 outlook with a specific focus on export markets and investment implications for manufacturers, traders, and capital stakeholders.

1. Industry Overview and Development Background

Wire and cable products are often described as the “arteries and nervous system” of the economy, enabling the transmission of electricity, signals, and data across virtually all sectors. Core downstream applications include power generation and transmission, construction and infrastructure, industrial manufacturing, telecommunications, transportation, oil and gas, and automotive industries.

By 2025, global structural trends have fundamentally reshaped demand patterns:

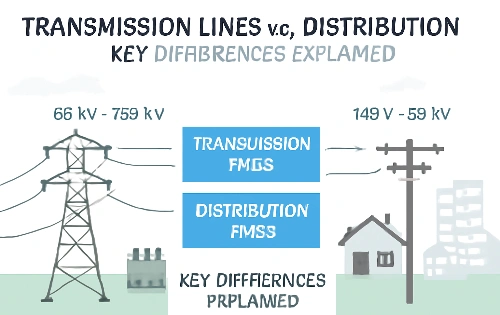

- Energy transition toward renewable power sources such as wind and solar has increased the need for high-voltage, extra-high-voltage, and submarine cables.

- Digitalization and AI-driven computing have fueled massive investments in data centers, fiber-optic networks, and high-performance data cables.

- Urbanization and infrastructure renewal in emerging economies continue to support stable demand for low- and medium-voltage cables.

- Electrification of transportation, particularly EVs and charging infrastructure, has created a fast-growing segment for specialized automotive and charging cables.

For export-oriented manufacturers, these trends translate into long-cycle, policy-supported demand with relatively high entry barriers, especially in high-voltage and specialty cable segments.

Table: Global Wire and Cable Market Size and Growth (2023–2026)

Purpose: Industry overview + First impression for investors to assess industry potential

Suggested placement: Executive Summary or Market Overview

|

Year |

Market Size (USD Billion) |

YoY Growth |

|

2023 |

240 |

– |

|

2024 |

268 |

11.7% |

|

2025 |

233 – 270 |

6.0 – 7.0% |

|

2026 |

245 – 255 |

6.0% |

Key Analysis Points

● The industry belongs to the "medium-to-high speed, long cycle, infrastructure-type" growth category.

● Investment attributes: Strong counter-cyclical capability, stable cash flow.

2. Global Market Size and Structure in 2025

2.1 Market Size

In 2025, the global wire and cable market maintained steady expansion, with an estimated market size ranging between USD 230–270 billion depending on the statistical scope. The medium-term compound annual growth rate (CAGR) remains approximately 6–7%.

From an export perspective, cross-border trade in wire and cable products continued to rise, particularly in:

- High-voltage power cables for international grid interconnection projects

- Submarine cables for offshore wind farms

- Optical fiber cables for telecom and hyperscale data centers

2.2 Regional Market Distribution

- Asia-Pacific: The largest and most competitive production and consumption hub, accounting for over 40% of global demand. China dominates both output and exports, while Southeast Asia and India show strong import growth.

- Europe: Demand driven by renewable energy integration, offshore wind, and grid decarbonization. High technical standards create opportunities for premium exporters.

- North America: Stable demand supported by infrastructure renewal, EV charging deployment, and reshoring of manufacturing.

- Middle East & Africa: Rapidly growing import markets due to energy, industrial, and urban development projects.

For exporters, Europe and the Middle East remain high-value destinations, while Southeast Asia and Africa represent volume-driven growth markets.

Table: Global Wire and Cable Market Regional Structure, 2025–2026

Purpose: To highlight key export markets

Location Recommendation: Regional Analysis

|

Region |

Market Share 2025 |

Growth Outlook 2026 |

Export Attractiveness |

|

Asia-Pacific |

42% |

High |

★★★★☆ |

|

Europe |

23% |

Medium–High |

★★★★★ |

|

North America |

18% |

Medium |

★★★★☆ |

|

Middle East & Africa |

10% |

High |

★★★★★ |

|

Latin America |

7% |

Medium |

★★★☆☆ |

Export Analysis

● Europe / Middle East and Africa = High Value-Added Export Markets

● Southeast Asia / India = Large-Scale Export Markets

3. Competitive Landscape and Key Players

The global wire and cable industry remains moderately concentrated. Multinational leaders such as Prysmian Group, Nexans, Sumitomo Electric, NKT, and Fujikura dominate high-end segments, including HVDC and submarine cables.

At the same time, export-oriented manufacturers from Asia have strengthened their global presence through:

- Cost-efficient manufacturing

- Rapid capacity expansion

- Localization strategies and overseas factories

From an investment standpoint, industry consolidation continues through mergers, acquisitions, and strategic partnerships, particularly targeting high-margin specialty cable businesses.

Table: Market Structure by Product Type (Investment Value Oriented)

Purpose: To help investors and companies determine "which products are most profitable."

Suggested Location: Product & Technology Section

|

Product Segment |

Market Share 2025 |

CAGR 2025–2028 |

Margin Profile |

|

45% |

4–5% |

Low–Medium |

|

|

High Voltage & HVDC Cables |

22% |

8–10% |

High |

|

Optical Fiber Cables |

15% |

7–9% |

Medium–High |

|

EV & Charging Cables |

10% |

12%+ |

High |

|

Specialty Industrial Cables |

8% |

9–11% |

High |

Capital Conclusion: HVDC, EV, and cable + fiber optic are the priority areas for capital investment.

4. Technology Trends and Product Innovation

Key technological directions shaping export competitiveness include:

- HVDC and EHV cables for long-distance and cross-border power transmission

- Environmentally friendly materials, including halogen-free and recyclable insulation systems

- Smart and monitored cables integrated with sensors for predictive maintenance

- High-density optical fiber cables for 5G, AI, and data center interconnection

Capital expenditure is increasingly directed toward advanced production lines, quality control systems, and compliance with international standards (IEC, UL, CPR).

5. Policy Environment and Sustainability Requirements

Governments worldwide continue to tighten regulations related to fire safety, environmental impact, and carbon emissions. For exporters, compliance with EU CPR, RoHS, and REACH regulations is no longer optional but a prerequisite for market access.

Sustainability has also become an investment screening criterion. Financial institutions increasingly favor manufacturers with:

- Transparent ESG reporting

- Energy-efficient production processes

- Circular economy initiatives, such as cable recycling

6. Risks and Challenges

Despite positive fundamentals, the industry faces notable risks:

- Volatility in copper and aluminum prices

- Geopolitical and trade-related uncertainties

- Increasing technical and certification barriers in developed markets

- Margin pressure in low-end commodity cable segments

Export-focused companies must balance scale expansion with margin protection through product differentiation.

Table: Major Export Destinations and Demand Drivers

Purpose: Foreign Trade and Market Expansion Decisions

Location Recommendation: Export Market Outlook

|

Export Region |

Core Demand Drivers |

Typical Products |

Entry Barriers |

|

Europe |

Offshore wind, grid upgrade |

HVDC, fire-resistant |

Very High |

|

Middle East |

Energy & infrastructure |

Power cables |

Medium |

|

Africa |

Urbanization, utilities |

MV/LV cables |

Low–Medium |

|

Southeast Asia |

Industrialization |

MV/LV, optical fiber |

Medium |

|

North America |

EV & data centers |

Specialty cables |

High |

7. Expanded Market Outlook 2026: Export and Investment Analysis

7.1 Global Market Forecast

In 2026, the global wire and cable market is expected to reach approximately USD 245–255 billion, maintaining a CAGR of around 6%. Growth will be uneven across segments, with high-voltage power cables, optical fiber cables, and EV-related cables outperforming the industry average.

7.2 Export Market Outlook

From an export perspective, three major growth corridors will dominate:

Europe: Strong demand for HVDC, submarine, and fire-resistant building cables driven by offshore wind expansion and grid interconnection projects. Exporters with proven project execution capability and certifications will benefit most.

Middle East & Africa: Large-scale energy, oil & gas, and urban infrastructure projects will continue to rely heavily on imported cables. Price competitiveness combined with engineering support will be key success factors.

Southeast Asia & India: Rapid electrification and industrialization create sustained demand for medium- and low-voltage cables. This region favors scalable production and flexible logistics.

7.3 Investment Implications

For investors, the wire and cable industry in 2026 presents a combination of stability and structural growth:

- High-voltage and submarine cable projects offer long-term contracts, high entry barriers, and predictable cash flows.

- Specialty cables (EV, data centers, industrial automation) deliver higher margins and faster growth.

- Export-oriented manufacturers with diversified regional exposure are better positioned to manage geopolitical risks.

Capital allocation is expected to focus on capacity expansion, overseas localization, digital manufacturing, and strategic acquisitions.

7.4 Strategic Recommendations

- Manufacturers should prioritize export markets with policy-driven demand and high technical thresholds.

- Investors should favor companies with strong order backlogs, certification portfolios, and international project experience.

- Long-term value creation will increasingly depend on technology leadership and ESG compliance rather than pure volume growth.

The global wire and cable industry entered 2026 with solid fundamentals, supported by irreversible trends such as energy transition, electrification, and digital infrastructure expansion. For export-driven enterprises and investors, opportunities are concentrated in high-end, policy-supported segments and fast-growing emerging markets. Strategic positioning, technological capability, and global market access will define competitive success in the next phase of industry evolution.

-AL-medium-voltage-power-cable-2.jpg)

SHOUOJ-mining-cable-2.webp)